Best Credit Cards for Insurance Spends in 2020

We all pay for some or the other insurance (Vehicle/ Health/ Life Insurance etc) annually, and this is one expenditure that’s there and who would not like to earn Reward Points (RPs) and free credit period for this necessary expenditure.

Lot of credit cards do not provide RPs on insurance payment, some do provide but with upper caps. In this article my attempt is to summarize the strategies for earning maximum RPs for insurance payments. Feel free to share your experiences of earning RPs for insurance payments.

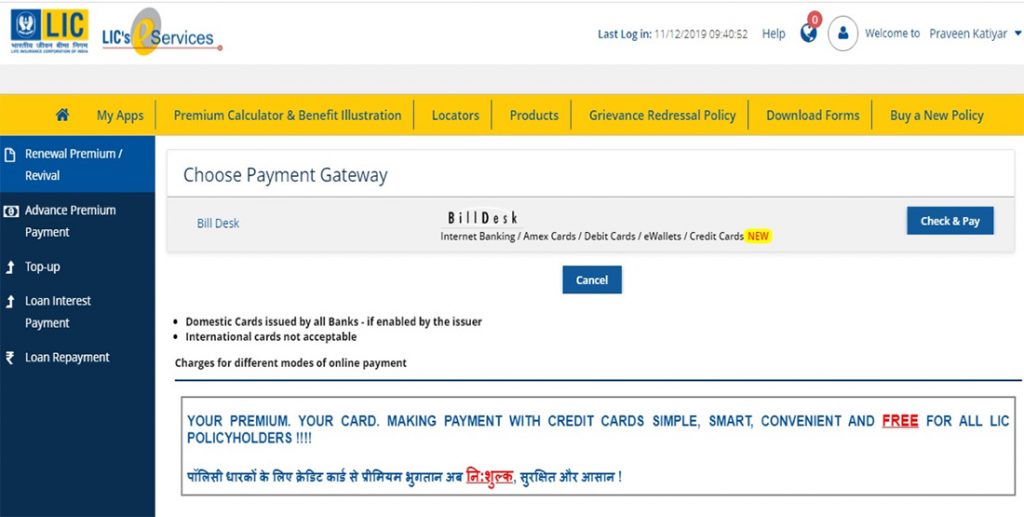

Before we get into the list, do note that beginning 1st Dec 2019, LIC removed all the upper payment limit (on a single transaction) and convenience fee on payments, made using credit cards as seen below,

I have not encountered any convenience fee on payment made to other insurance provider (Barti Axa/ Sriram Gen Insurance etc.) as well when using Credit Cards.

So now this brings us to the question that if no convenience fee is levied on insurance payment, which are the best credit cards to pay insurance premium to earn maximum RPs.

I would like to simplify the answer to this question by categorising it, by credit card ‘Issuing bank’ wise and also card-wise (important ones) wherever possible,

HDFC Bank

- Diners Black/ Infinia: Maximum cap of 2000 RPs per txn & 5000 RP’s per day for Insurance payments.

- Other HDFC Cards: Maximum cap of 2000 RPs per day for Insurance payments.

Apart from this, they also run 2X/ 5X Rewards points promo on insurance once in a while.

SBI Cards

- ELITE: 2 Reward Point/100 spent (0.5% in value)

- Prime: 2 Reward Point/100 spent (0.5% in value), you can earn 20 Reward points/100 on Standing Instruction (capped at 3000 points/ month)

- IRCTC Card: 1 Reward Point/125 spent (0.8% in value)

Elite & Prime may make sense as it also helps to reach milestone rewards which raises the reward rate.

Axis Bank

- Vistara Credit cards: as per the card variant, which is as grand as ~10% on Vistara Infinite credit card

- Axis Privilege Credit Card: 2% as Travel vouchers

- Axis Flipkart Credit Card: 1.5% as cashback without any capping.

For most regular & premium credit card users, Axis gives the best returns on insurance spends as these cards are linked with handsome milestone rewards.

ICICI Bank

- EMERALDE / CORAL / RUBYX / SAPPHIRO: 1 PAYBACK Point/100 spent (0.25% in value)

- Amazon Pay Credit Card: 1 % back as Amazon Pay balance (1% in value)

While Amazon Pay credit card might seem the best, Emeralde also may work out good for some as the annual fee is waived on 15L spend. Good for those who have high insurance spends.

Standard Chartered

- Ultimate: 5 reward points/150 spent (3.3% in value)

Yes Bank Credit Cards

Yes Bank gives RPs for Insurance payments based upon respective card earn rate. For example

- Yes First Exclusive: 6 RPs/100 spent (1.5% in value)

- Yes First Preferred: 4 RPs/100 spent (1% in value)

Both comes with milestone rewards as well, so that may help to raise the return a bit.

American Express

Amex does not give RPs on Insurance payment but you get milestone rewards for example with Amex platinum Travel Card. They also sometimes come up with offers like 5X Reward Points with caps on Insurance spends.

You may also use Amex cards to load wallets and pay insurance from there. This way you get points even with Amex Cards. Feel free to load in multiples of 1000’s and grab the monthly bonus on Amex Mrcc