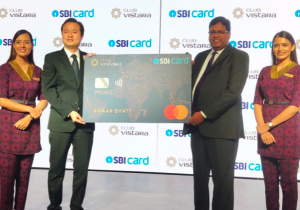

SBICard Launches Vistara Co-Branded Credit Cards

SBICard – the 2nd largest credit card issuer in the country has launched a new airline co-brand credit card in partnership with Air Vistara – the premium airline of the country. There are two variants and the cards run on MasterCard network, gives complimentary flight tickets, hotel vouchers, free cancellations, lounge access & more based on the credit card spends. Here’s everything you need to know.

Club Vistara SBI Card (Basic)

- Fees: 1499+GST

- Welcome Bonus: 1 Economy tkt + 1000 CV Points (on 50K spend)

- Regular Rewards: 3 CV Points/200 Rs. Spend (Reward rate: ~1.1%)

- Milestone 1: Complimentary Economy tkt on 1.25L spend

- Milestone 2: Complimentary Economy tkt on 2.5L spend

- Milestone 3: Complimentary Economy tkt on 5L spend + 5K Yatra Hotel Voucher

- Insurance Benefit: Cancellation – Up to 4 cancellations, each covers up to Rs 3500

- Lounge Access: Domestic via Mastercard (4/yr – 1/qtr)

So if you manage to spend Rs.5 lakhs, you get ~6000 CV Points & 3 complimentary Vistara economy Flight tickets (excl. welcome benefit). If we consider all these, the approx. return on spend is 4% (assuming 1 eco tkt = Rs.3500)

Ofcourse the numbers may vary if you fly busy routes like BOM/DEL.

Club Vistara SBI Card PRIME (Premium)

Oops! they’ve successfully messed up the name by adding PRIME here and confuse customers.

- Fees: Rs.2999+GST

- Welcome Bonus: 1 Premium Economy tkt + 3000 CV Points (on 75K spend)

- Regular Rewards: 2 CV Points/100 Rs. Spend (Reward rate: ~1.5%)

- Tier Benefit: CV Silver tier

- Milestone 1: Complimentary Prem. Economy tkt on 1.5L spend

- Milestone 2: Complimentary Prem. Economy tkt on 3L spend

- Milestone 3: Complimentary Prem. Economy tkt on 4.5L spend

- Milestone 4: Complimentary Prem. Economy tkt on 8L spend + 10K Yatra Hotel Voucher

- Insurance Benefit: Cancellation – Up to 6 cancellations, each covers up to Rs 3500

- Lounge Access: Domestic via Mastercard (8/yr – 2/qtr) & International via Priority Pass (4/yr – 2/qtr)

So if you manage to spend Rs.8 lakhs, you get 18,000 CV Points + 4 complimentary Vistara Premium economy Flight tickets + 10K hotel voucher and some upgrade vouchers. If we consider all these, the approx. return on spend is well over 7% which is AMAZING. (assuming 1 prem. eco tkt = Rs.7500)

Should u apply?

SBIcard allows only two cards, usually one regular card like Elite, Prime and one co-brand card.

Speaking about the best SBI co-brand card, I would go with Air india Signature over Vistara cards unless SBI allows me to hold 2 co-brand cards and that’s not because Air India card is superior, but its unique.

But if you don’t need Air India card, then Vistara Prime gives amazing value and is better than the Axis Vistara Signature which is of same range.

Note: Given the history of SBICard dealing with newly launched card applications, I would suggest you to wait for a week or two before clicking that apply button