Lazypay, Slice, Postpe, Kreditbee – Fine prints & comparison

The credit lines cards such as Lazypay ,slice ,postpe, kreditbee are becoming popular these days . So i decided to look over these cards and was surprised by the permission they seek .

Lazypay vs Slice vs Postpe vs KreditBee

These card are not actually credit cards but act or behave like credit cards in true sense they are just credit offered by financial instituions

- Lazypay Lazypay is a digital credit platform that offers instant personal loans of up to Rs. 1 lakh to individuals. Here are some of the fine prints associated with Lazypay:

- Eligibility Criteria: Individuals between the ages of 22 and 55 years, with a minimum monthly income of Rs. 15,000, are eligible to apply for a loan with Lazypay.

- Interest Rates: Interest rates start at 15% per annum, and can go up to 28% per annum, depending on the loan amount and repayment tenure.

- Repayment Options: The loan amount can be repaid in 3, 6, or 9 equal monthly installments (EMIs).

- Other Charges: A processing fee of up to 2.5% of the loan amount, and a late payment fee of up to Rs. 250, are applicable.

- Slice Slice is a fintech platform that offers instant credit to students, young professionals, and other individuals in India. Here are some of the fine prints associated with Slice:

- Eligibility Criteria: Individuals between the ages of 18 and 29 years, with a minimum monthly income of Rs. 15,000, and a credit score of 750 or above, are eligible to apply for a loan with Slice.

- Interest Rates: Interest rates start at 15% per annum, and can go up to 36% per annum, depending on the loan amount and repayment tenure.

- Repayment Options: The loan amount can be repaid in 3, 6, or 12 equal monthly installments (EMIs).

- Other Charges: A processing fee of up to 2% of the loan amount, and a late payment fee of up to Rs. 500, are applicable.

- Postpe Postpe is a digital lending platform that offers personal loans, business loans, and other financial products in India. Here are some of the fine prints associated with Postpe:

- Eligibility Criteria: Individuals between the ages of 18 and 60 years, with a minimum monthly income of Rs. 20,000, are eligible to apply for a loan with Postpe.

- Interest Rates: Interest rates start at 14% per annum, and can go up to 30% per annum, depending on the loan amount and repayment tenure.

- Repayment Options: The loan amount can be repaid in 3, 6, 9, or 12 equal monthly installments (EMIs).

- Other Charges: A processing fee of up to 2% of the loan amount, and a late payment fee of up to Rs. 500, are applicable.

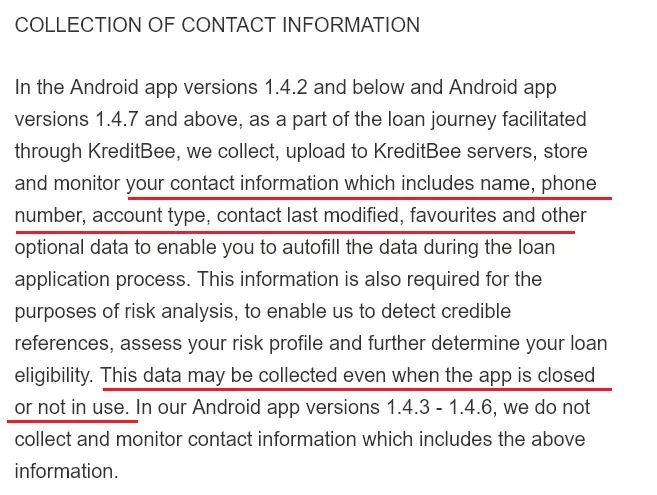

- Kreditbee Kreditbee is a digital lending platform that offers personal loans, education loans, and other financial services in India. Here are some of the fine prints associated with Kreditbee:

- Eligibility Criteria: Individuals between the ages of 21 and 57 years, with a minimum monthly income of Rs. 20,000, are eligible to apply for a loan with Kreditbee.

- Interest Rates: Interest rates start at 18% per annum, and can go up to 29.95% per annum, depending on the loan amount and repayment tenure.

Here’s a table comparing the key features of Lazypay, Slice, Postpe, and Kreditbee:

| Feature | Lazypay | Slice | Postpe | Kreditbee |

|---|---|---|---|---|

| Eligibility | 22-55 years, minimum monthly income of Rs. 15,000 | 18-29 years, minimum monthly income of Rs. 15,000, credit score of 750 or above | 18-60 years, minimum monthly income of Rs. 20,000 | 21-57 years, minimum monthly income of Rs. 20,000 |

| Loan Amount | Up to Rs. 1 lakh | Up to Rs. 60,000 | Up to Rs. 5 lakh | Up to Rs. 1 lakh |

| Interest Rates | 15%-28% per annum | 15%-36% per annum | 14%-30% per annum | 18%-29.95% per annum |

| Repayment Options | 3, 6, or 9 EMIs | 3, 6, or 12 EMIs | 3, 6, 9, or 12 EMIs | 2, 3, or 6 EMIs |

| Processing Fee | Up to 2.5% of the loan amount | Up to 2% of the loan amount | Up to 2% of the loan amount | Up to 3% of the loan amount |

| Late Payment Fee | Up to Rs. 250 | Up to Rs. 500 | Up to Rs. 500 | Up to Rs. 1,000 |

Lazypay, Slice, Postpe, KreditBee – Instant issuance but with lots of permissions

There is some concerns of these cards with the type of permissions they take .

IT is very easy to get these cards but it has many concerns like they take your accounts information,phone informations ,contact information etc

These take these permissions to put you in pressure in case of default .

SUMMARY

If you are applying for any of Lazypay, Slice, Postpe, KreditBee cards, make sure of what you are getting into because they take your personal information I believe taking a seured credit card such as SBI, KOTAK etc is still a better option. In case you are taking these cards since you are a student or your income doesn’t meet the criteria for credit cards, I suggest focusing on your education or job/business and soon banks will line up to offer their best cards to you.