Pay Income Tax Online through Credit Card (India)

The ability to pay income tax online through credit card is great to have and we got this option in India since past few months. I just made a tax payment through credit card and it was a super smooth process, thanks to IT authorities for making this possible.

Here’s everything you need to know about making income tax payments (advance tax, TDS, etc) through income tax eFiling portal.

- Visit Income Tax efilling Portal

- Navigate to “e-Pay Tax” section on the left

- Enter your PAN/TAN details & authenticate mobile # via OTP

- Choose type of tax, then choose FY/AY & other details

- Choose “Payment Gateway” & make payment

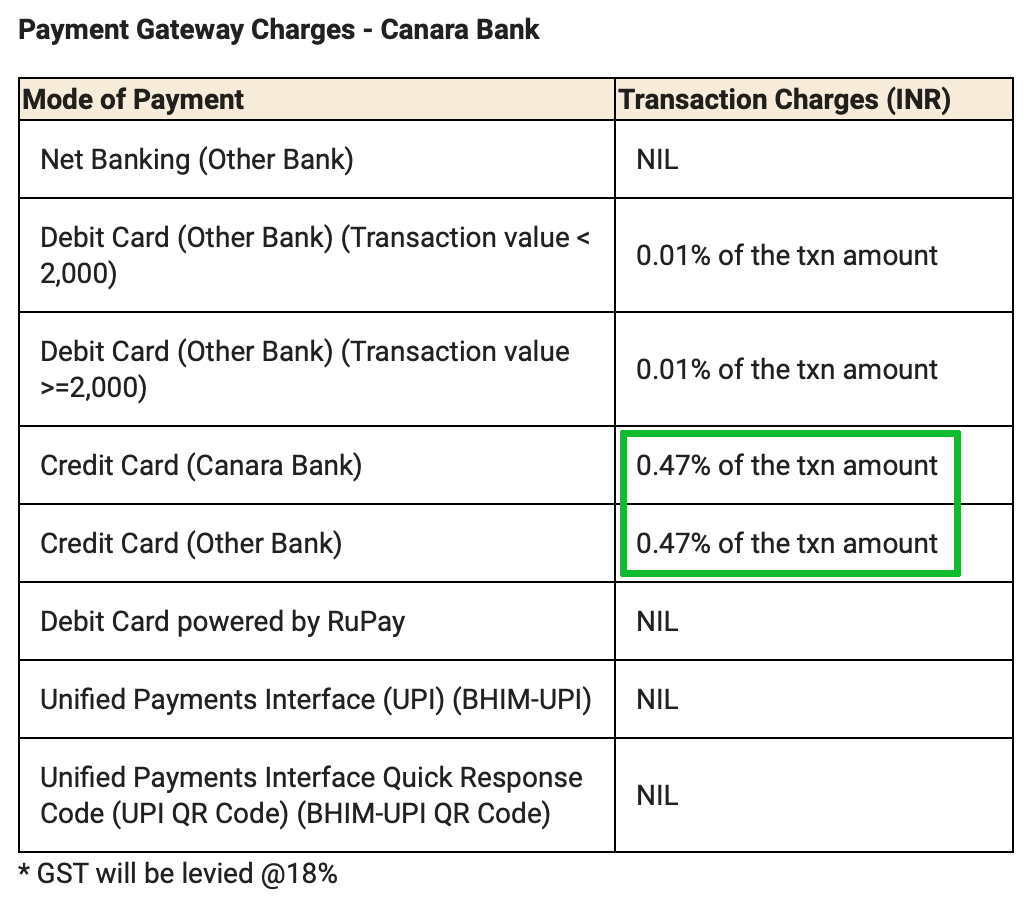

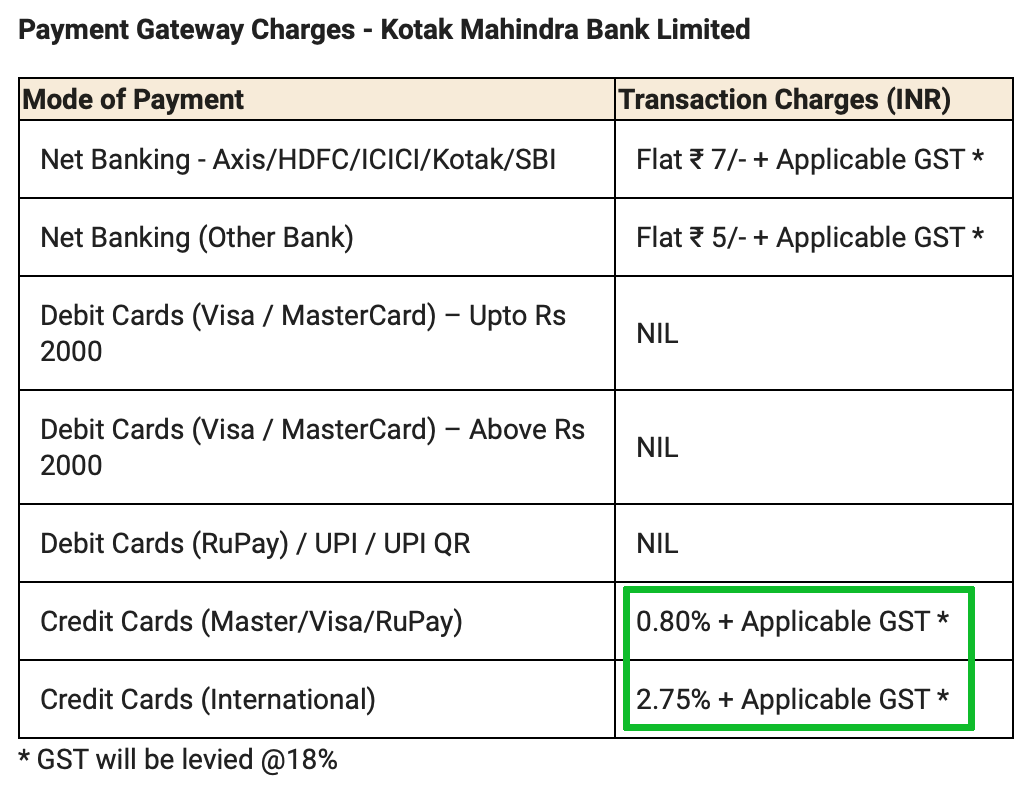

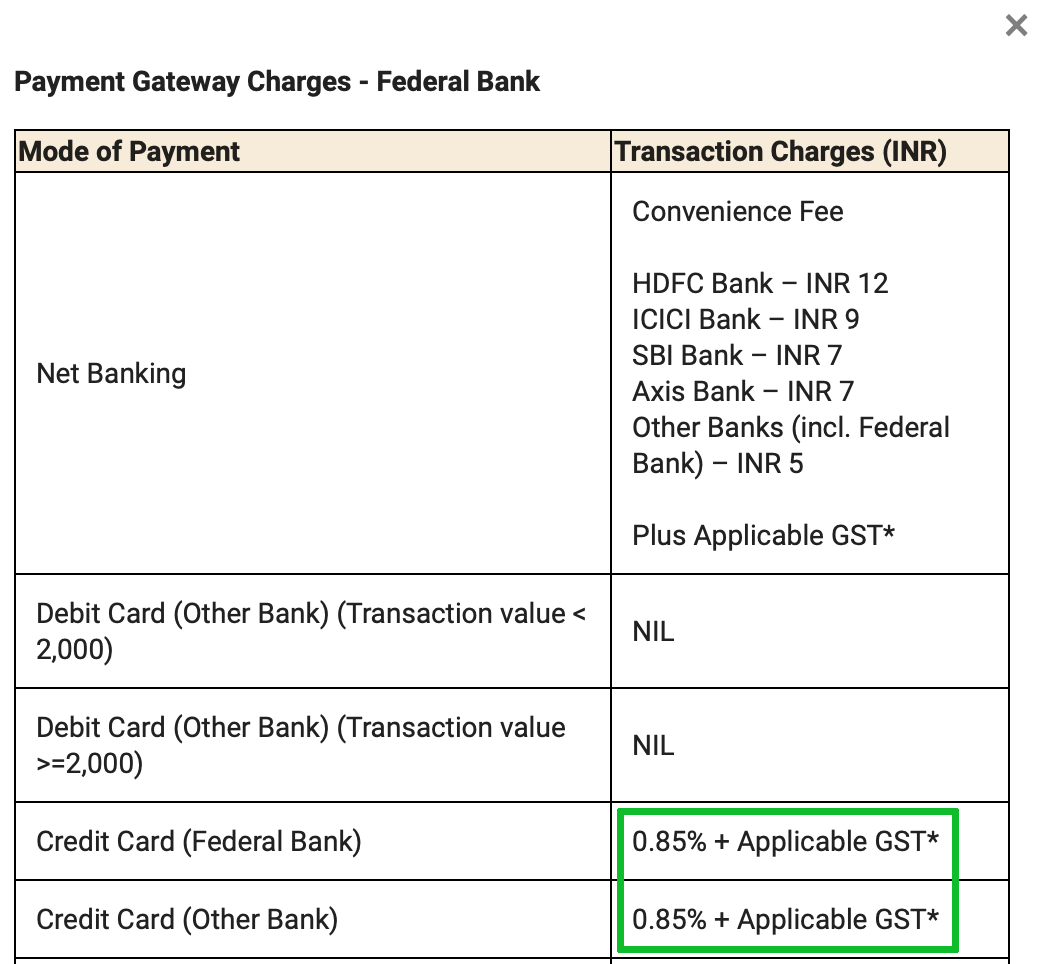

Note: Choose the payment gateway based on the txn charges. You may find the respective gateway charges by clicking on the “transaction charges” link

Transaction Charges

- Credit Cards: As low as 0.47% + GST (Canara Bank)

- Debit Card: 0% (mostly)

Note that the transaction charges are different for different payment gateways and that the charges are dynamic and keep changing from time to time.

As of today (14 Dec 2022), Canara Bank payment gateway has the lowest transaction fee. Do verify the same before choosing the payment gateway and re-confirm the fee on the next step.

Here are the current charges as of Dec 2022 that I see on the portal.

Why Pay via Credit Cards?

Paying taxes through credit cards does attract a small transaction fee. So if you’re new to credit cards and ask me “Why pay fee?” Here are some of the reasons,

1. Annual Fee Waiver: If you’re holding Premium credit cards, it comes with an annual fee waiver condition based on spends of “X Lakhs” in a card anniversary year. These tax payments can get you closer to it.

2. Rewards: While most Credit Cards may not give reward points for government transactions, you may just use it to avail at-least the milestone benefits.

For ex, a tax payment of 1.2L INR on Axis Visatra Infinite Card will not only get you a free card but also a free business class ticket + 10K Points equivalant to another 2 economy tickets. That’s 3 flights for Free!

If you do not have credit cards with milestone benefit, all you need to do is to make sure your credit card regular reward rate % is more than the txn fee % that you’re being charged.

3. Additional Credit Period: You can easily get 30+ days to pay back your credit card bill, so it’s an added advantage just incase if you’re in a cash crunch. If you’re paying EMI/interest for loans, consider it as a cheapest loan for a month.

If you still feel that you don’t wish to pay the transaction fee, you may also choose to pay with debit cards at 0% fee. While you may or may not get rewards, this will help to keep the debit cards active.

My Experience

The user experience was ultra smooth while making advance tax payment on the Income tax eFiling portal.

I’ve used Axis Magnus Credit Card this time to get closer to current month’s milestone benefit. You may as well use any card that gives decent milestone benefits..

Final Thoughts

It’s great to see that the government has not only taken steps to include credit card as a payment option for making online tax payments but also implemented it pretty well.

This is a great option for the citizens of India but appears to be not so great for banks, as both Axis Bank (eff. 15 Nov) & HDFC Bank (eff. 1st Jan) recently notified it’s customers that they will no longer give rewards for the government transactions.