SBI IRCTC Platinum Credit Card Review

Many of my friends & relatives hold an SBI credit card and its usually the SBI IRCTC Platinum Credit Card because most of them travel at least once a month via train between their native and work location. As it helps to save upto 10% on IRCTC spends, its definitely a worthy card to hold. Let’s see in detail below,

Joining Fees

- Joining/Renewal Fee: Rs.500+GST

- Welcome Benefit: 350 points

The welcome benefit kind of sets off the fee partially, which makes Sense for a low fee card with a very good return on spend on IRCTC train bookings.

Rewards

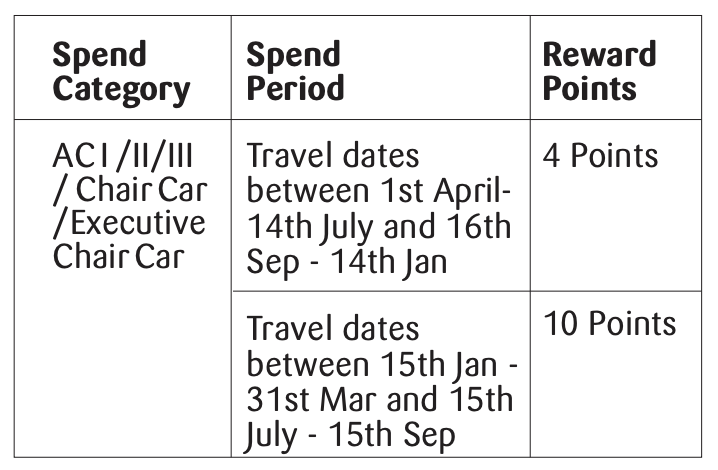

- IRCTC Train Bookings – Peak Season: 10% as points (AC1, AC2. AC3 and AC CC)

- IRCTC Train Bookings – OFF Season: 4% as points (AC1, AC2. AC3 and AC CC)

- All other spends: 0.8% as points (1 Reward point for every Rs. 125)

- 1 Reward point = Rs.1

Note: To be eligible for the rewards, booked ticket must have one Traveller same as the name on the card

Features & Benefits

- Save 1.8% transaction charges on railway ticket bookings

- 1% fuel surcharge waiver, on txns of Rs. 500 – Rs. 3,000, exclusive of GST and other charges (maximum surcharge waiver of Rs. 100 per statement cycle)