Indusind Bank Multi-currency Forex Card Review

I had a recent trip to Singapore & Malaysia so thought to give a try to Indusind Forex card which is by far the best in market for now. I have IndusInd exclusive signature debit card which serves all the international transaction purposes, but I took this IndusForex card just to experience how the forex card works, as there is quite a noise for Forex cards in the country.

Features & Benefits of Indus Forex Card:

- ZERO Currency Conversion Charges

- ZERO ATM withdrawals Fee (Upto 2/Month/currency)

- ZERO Processing Fee

- ZERO Issuance Fee (temporary offer)

- Online Usage Enabled

- Validity: 3 Years

- 24/7 Online Booking

- Delivery & Activation within 24-48 Hrs

Ideally, you can get almost exact value of the currency on the said date without any other hidden fees, which made me apply for one. Currencies Offered: United States Dollar, Euro, Australian Dollar, Great Britain Pound, Singapore Dollar, Saudi Riyal, Canadian Dollar & UAE Dirham

Indusind Multi-currency Forex Card Application Process:

- Day 1: Applied online for 100 SGD (minimum) with a coupon code: CARD150 so the card issuance fee gets waived off.

- Day 2: Opted for Branch delivery though received the instant kit delivered at home (exclusive banking benefit) after submitting the documents (flights & Visa) and the card was activated the same day.

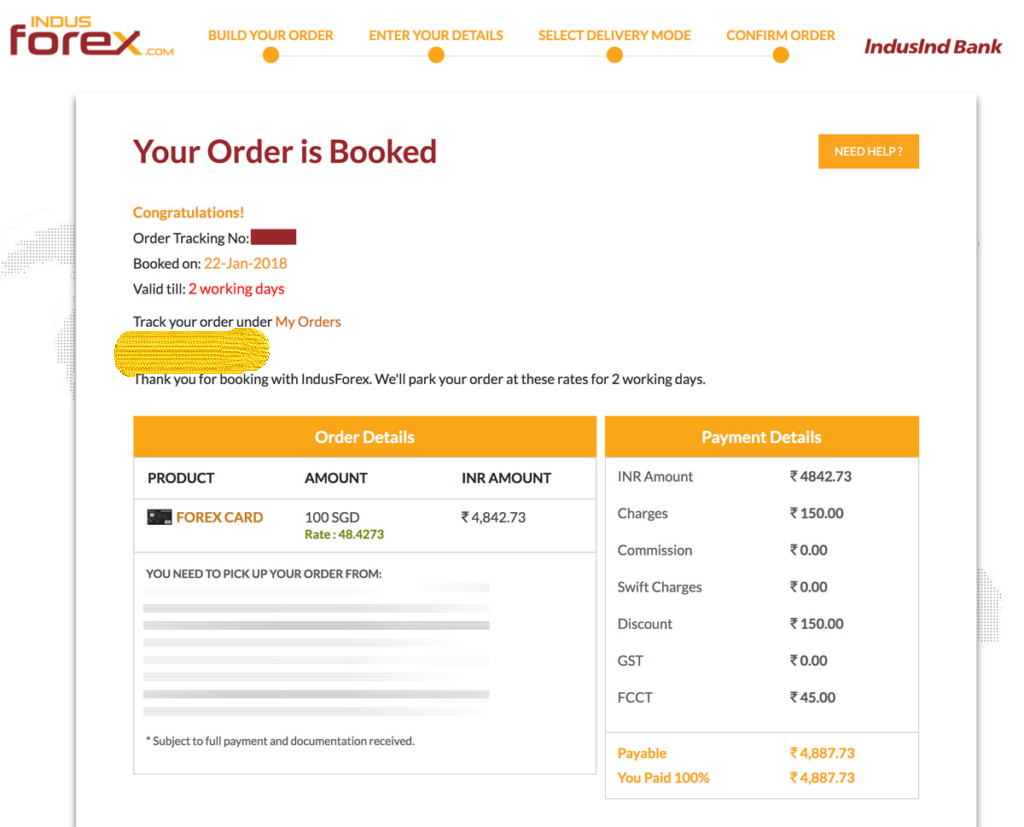

Indusind Bank Forex Card Booking

The rates are in par with Xe.com values with minor difference, as bank’s BUY rate differs from actual worldwide conversion rate.

Additional Savings: While you can pay for the above using net banking, fortunately, you can also pay using a Visa/MC credit/debit card. However it comes with ~2% extra fee which i opted for and paid with my HDFC Jet privilege world credit card

Doing so, i need to pay ~Rs.100 extra but i get ~200 JP Miles which means i’m technically buying 1 JP Mile for 50 paise. It makes sense to me as i try my best to get a value of Rs.1 for 1 JPMile.

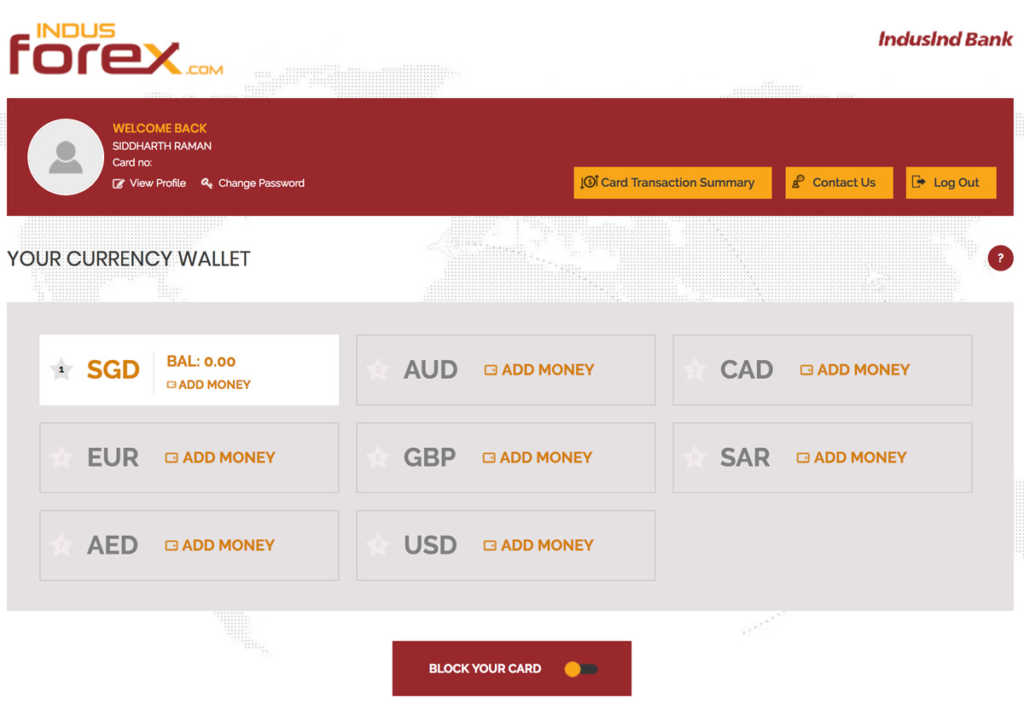

Managing the IndusForex Multi-currency Card:

The dashboard looks neat and clean with the basic info. You can view the balances across multiple currencies in a single page and yes you can also view your txn summary online in a click. You’ve everything that you need in a forex card in a simple interface like this:

Important Things to note:

- If you transact in a currency that’s different from base currency, you’ll be charged 3.5% markup fee. Hence, this card is good only if you can spend in the currencies that they offer.

- They do address verification. I applied using Aadhaar OTP and they verified my permanent address as on Aadhaar after ~2 weeks when i was actually back from the Trip. I didn’t apply using my existing ac info as it pulled the data with some errors.