HDFC Bank Launches Credit, Debit, EMI & Prepaid Cards for Millennials

India’s largest credit card issuer, HDFC Bank today has launched series of cards: Credit/Debit/ Prepaid/EasyEMI cards in partnership with MasterCard, targeting the millennials of India, the segment that account for 34% of India’s population. Here’s a look into all of them:

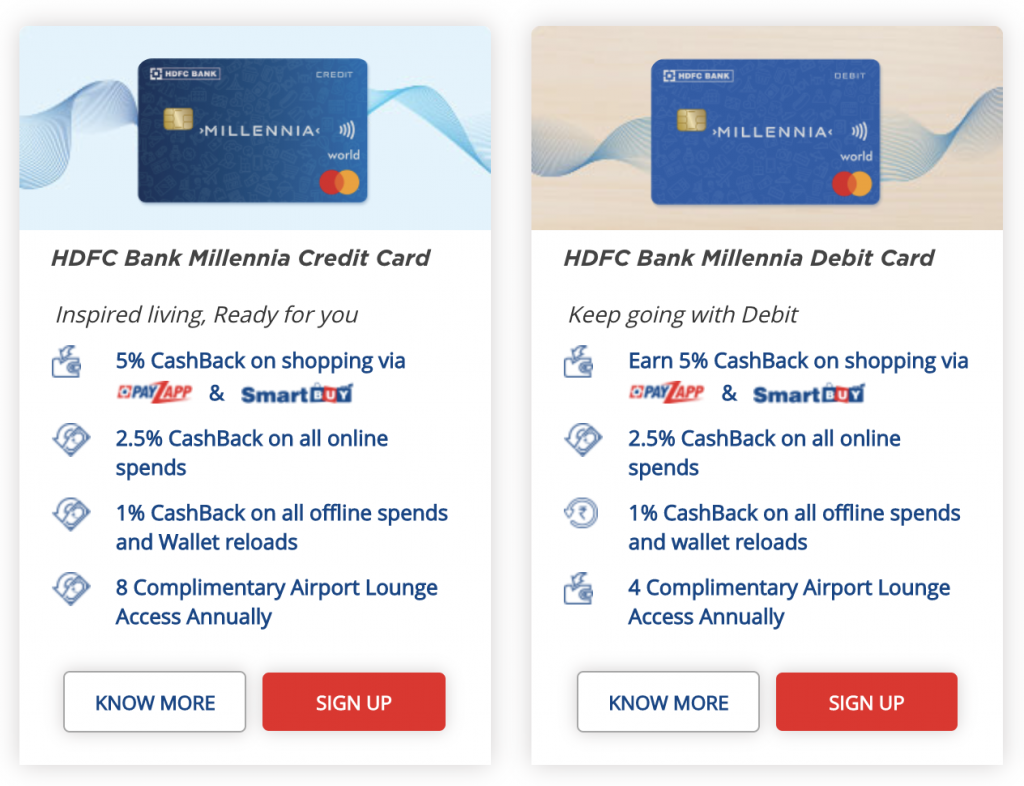

These are basically the cards for beginners with similar benefits across all card types (Credit/Debit/Prepaid/EasyEMI) and are tuned towards the lifestyle of Millennials. A quick look at the features of credit & debit cards are here:

For more details, visit the bank site here

Millennia Credit Card – Overview:

Let’s look at credit card benefits/features alone for now,

- Fee: Rs.1000+GST (waived off if you spend ₹30,000 and above in the first 90 days)

- Renewal membership fee will be waived off if you spend ₹1,00,000 and above in the first year

- Launch offer of ₹1000 worth gift vouchers on spends of ₹1,00,000 and above in each calendar quarter for first year only.

- 5% CashBack on Amazon, Flipkart, Flight & Hotel bookings on shopping via PayZapp and SmartBuy (minimum transaction size of ₹2000)

- 2.5% CashBack on all online spends (minimum transaction size of ₹2000)

- 1% CashBack on all offline spends and Wallet reloads (Minimum transaction size of ₹100)

- 8 Complimentary Domestic Airport Lounge access annually

- 1% Fuel surcharge waiver

Worth it?

With good minimalistic design & 2.5% cashback on Online Spends (txn: >2k INR) that simply replaces most other cashback cards in the industry.

But hey, the upper cap is “Rs.750 per month” for this category. That’s about Rs.30k monthly spend which is bit low but still good for most “regular” credit card users.

So it all looks good for now, we will know how this actually works in reality soon.