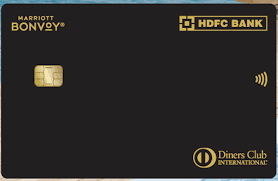

HDFC Bank has introduced the much-anticipated co-branded Marriott Bonvoy HDFC Bank Credit Card

HDFC Bank and Marriott have united to unveil the collaborative Marriott Bonvoy HDFC Bank credit card. This card entails an enrollment fee of Rs. 3000 plus applicable taxes, catering especially to frequent voyagers who hold a steadfast allegiance to the Marriott brand. With this card, you are granted complimentary Marriott Silver Elite Status and have the potential to accumulate up to 4 complimentary night awards, contingent on your expenditures.

Features

Upon initial registration and with each successive card renewal, a gratifying welcome bonus awaits you in the form of a 1 Free Night Award, esteemed at approximately 15,000 Points. This valuable award remains valid for a span of one year, applicable at all esteemed lodgings participating in the expansive Marriott Bonvoy program across the global spectrum. However, do note that specific establishments may levy separate resort fees upon redemption of the 1 free night award.

To avail yourself of the free night award, it is imperative to secure your booking through either the official Marriott.com website or the dedicated mobile application. Furthermore, the e-certificate must be applied directly at the chosen hotel. It’s noteworthy that you have the option to employ up to 15,000 points to enhance the value of your complimentary award night. This expanded value grants access to an extended array of resorts and accommodations encompassing the diverse offerings of Marriott Bonvoy’s 30 distinct brands.

Beyond the inaugural gesture of the 1 complimentary night award bestowed upon card activation, an opportunity arises to acquire an extra trio of free night awards by attaining the specified spending milestone within the annual period. Attaining eligible transactions of Rs. 6 Lakhs, Rs. 9 Lakhs, and Rs. 15 Lakhs during the card anniversary year warrants an additional 1 free night award for each respective threshold. Notably, these free night awards are exclusively designated for the primary cardholder and are allocated to your personal Marriott Bonvoy membership account within a span of 8 to 12 weeks.

Insurance Benefits

The cardholder gets the following insurance benefits –

- Air Accident Cover – Rs. 10 Lakhs

- Delay or Loss of Check-In Baggage – $250

- Loss of passport and other travel documents – $250

- Delay in Flight – $250

- Emergency medical expenses – Rs. 15 Lakhs

- Credit Shield and Loss Liability Cover – Rs. 1 Lakhs each

Fees and Charges

- The joining and annual fees of the credit card is Rs. 3000 plus taxes

- The interest rate on the credit card is 3.6% per month

- The cash advance fee on the card is 2.5% of the transaction amount or Rs. 500, whichever is higher

- The forex markup fee on the card is 3.5% of the transaction amount

The cardholder receives the welcome benefits only after successfully paying the annual or joining fee of the card. Customers who received the card lifetime free or do not pay the joining fee will not receive the welcome benefits.

Eligibility Requirements

- Salaried Indian citizens must be between 21 to 60 years of age, and must have a minimum monthly income of Rs. 1 Lakh.

- Self-Employed Indian citizens must be between 21 to 65 years of age, and must have an ITR of more than Rs. 15 Lakhs per year.

It takes around 3 to 5 business days for card approval and the card is delivered within 7 business days once the application is approved.

Marriott Bonvoy Program Membership Number Generation

Once the credit card is approved, the Membership Number is generated within 10 business days. After the Membership Number has been generated, an official communication is received by the cardholder from Marriott on the registered Email ID and phone number.

If the cardholder’s email ID and phone number are linked to an active Marriott Bonvoy membership and are provided in the application form, the credit card will be linked to the existing Membership Number, and the earned reward points will be credited to this account. Should an existing Membership Number not be provided, automatic enrollment will take place, resulting in the allocation of a new Membership Number. A 30-day window is granted to merge both membership accounts, during which the freshly assigned Membership Number will assume the role of the primary account.

Inquiries about possessing an existing Marriott Bonvoy account number will be made during the credit card application process. In the event that such information is not supplied, delivery of the new Membership Number will transpire within 10 business days subsequent to application approval. To understand the procedure for merging two Marriott Bonvoy accounts into a single one, reference should be made to the provided link.

Summary

Marriott International is counted among the world’s premier hospitality enterprises, with opulent hotels and resorts encompassing the global landscape under its umbrella. Its membership program, Marriott Bonvoy, is recognized for its substantial rewards and furnishes an array of remarkable amenities and advantages to its members.

A partnership has been established between HDFC Bank and Marriott to introduce the Marriott Bonvoy HDFC Bank credit card, offered at a joining fee of Rs. 3000 plus applicable taxes. This card holds particular appeal for regular patrons of Marriott, as it grants a complimentary Silver Elite Status and extends the possibility of receiving up to 4 free award nights. Alongside these benefits, the card also offers privileges such as accelerated reward points, access to airport lounges, and a selection of insurance benefits.